Best Broker For Forex Trading Fundamentals Explained

Best Broker For Forex Trading Fundamentals Explained

Blog Article

The 25-Second Trick For Best Broker For Forex Trading

Table of ContentsThe Facts About Best Broker For Forex Trading UncoveredThe Ultimate Guide To Best Broker For Forex TradingThe Greatest Guide To Best Broker For Forex TradingThe smart Trick of Best Broker For Forex Trading That Nobody is DiscussingFacts About Best Broker For Forex Trading Revealed

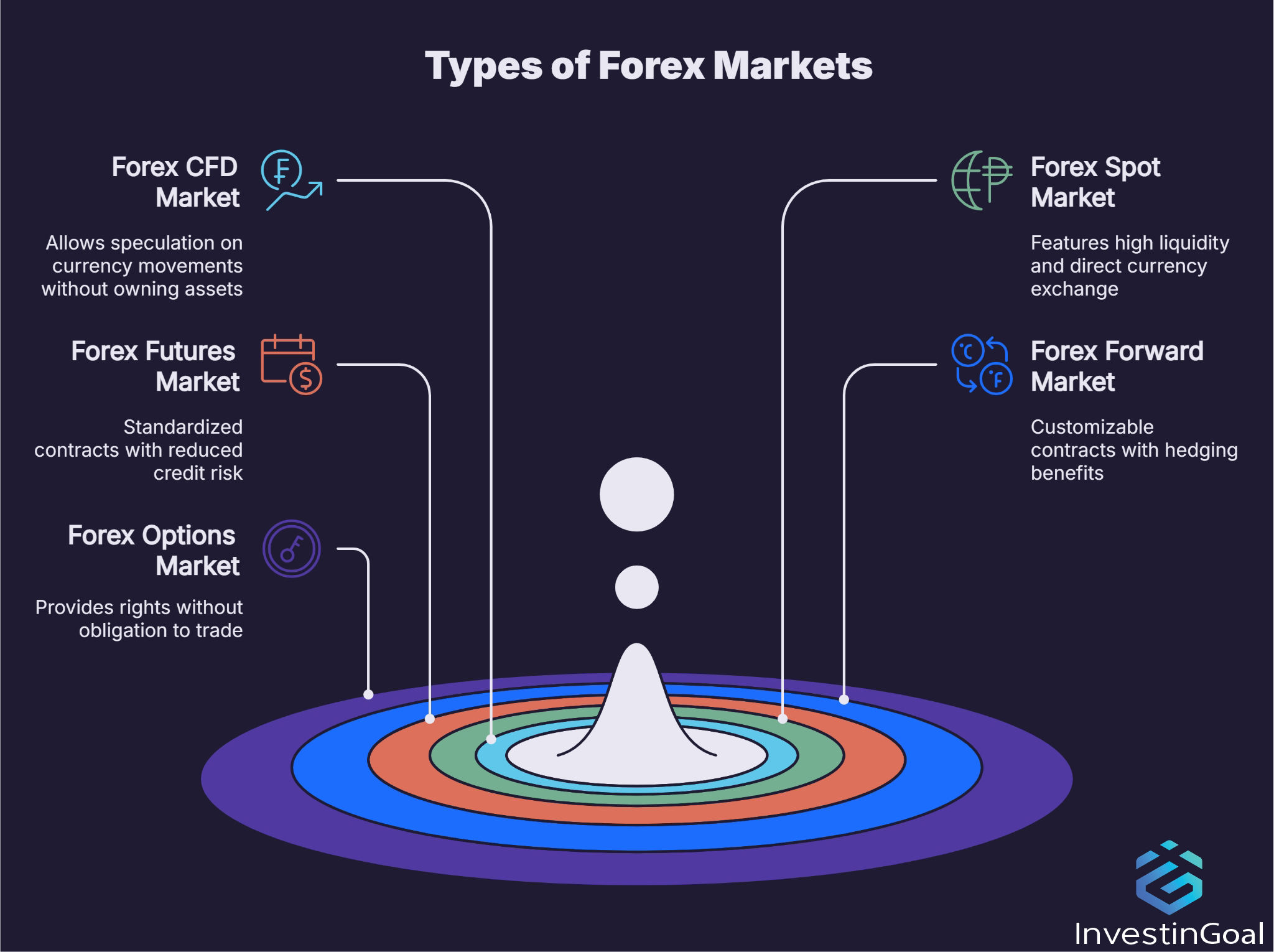

Trading foreign exchange includes concurrently purchasing one money and offering another. The initial currency in the set is called the base currency and the second is called the counter or quote currency.Portfolio managers make use of the foreign exchange market to diversify their holdings (Best Broker For Forex Trading). Prior to beginning to trade foreign exchange, it is useful to invest a long time discovering the marketplace and aspects such as the risks of making use of utilize. There are many great free resources available online to assist you with this, such as the education and learning area of this web site

At the same time, forex brokers based offshore normally have really little regulative oversight and are more risky to deal with. Lots of brokers call for really reduced minimum deposits to get going. There is often a $0 minimum to open up an account. Due to regulatory demands, some brokers now have a 'Know your Consumer' (KYC) questionnaire as part of the application.

It might consist of some basic questions concerning trading foreign exchange and CFDs. New foreign exchange traders ought to be mindful of overnight swap charges. These are the charges for holding a leveraged setting overnight and can add up to be significant. An additional typical fee among forex brokers is a lack of exercise charge, which is charged after an account has actually been inactive for a collection duration.

What Does Best Broker For Forex Trading Do?

Prior to trading in an online account it is a good idea to develop a strategy and test it in a trial account. Additionally, mini accounts and adaptable whole lot sizes permit new investors to experiment genuine cash while keeping danger to a minimum. Beginning a trading journal is a wonderful method for brand-new traders as it helps to recognize strengths and weaknesses and track progression.

Trading based on economic information is an instance of a fundamental technique. An investor might be viewing the United States employment report and see it can be found in worse than the consensus anticipated by experts. They may then determine to buy EUR/USD based upon an assumption that the dollar will certainly weaken on the unsatisfactory United States data.

Looking for price outbreaks towards the prevailing market fad is an example of a technical trading technique. The London Opening Variety Outbreak (LORB) is an instance of such a strategy. At the time of the London open, investors using this technique try to find the cost of GBP/USD to burst out over a current high or below a current low on the per hour chart with the expectation that price will certainly remain to trend in that instructions.

Below investors seek specific chart patterns that indicate whether rate is most likely to reverse or proceed to fad parallel. The Pin Bar is a prominent turnaround pattern. Right here, cost reaches a brand-new high (or low) and after that reverses to close near where it opened, suggesting an absence of conviction among the bulls (or bears).

The Ultimate Guide To Best Broker For Forex Trading

hold market placements for months or also years. Holding such long-lasting placements in the foreign exchange market has the prospective advantages read of making money from major price fads and also being able to earn rate of interest from a favorable interest rate differential. One of the most preferred graph types in forex trading are Bar Graphes, Candle Holder Charts and Line Charts.

are similar to Bar graphes because they display the high, low, open, and closing prices for an established time duration. Candle holders make it simple for traders to understand whether the marketplace is favorable or bearish within a given duration by tinting the area between the open and close eco-friendly or red.

Little Known Questions About Best Broker For Forex Trading.

just attract a line from one closing cost to the next closing rate. This chart type makes it very easy to check out rate fads yet supplies little understanding right into what took location over each period. Foreign exchange trading can be rewarding, however the statistics shared by major brokerage firms reveal that most of traders lose cash.

It ought to also be stressed that timing the market and trying to forecast temporary moves in the marketplace are extremely tough. Margin is the first funding required to open up and hold a leveraged placement in the marketplace. A margin need of 1% corresponds to offered utilize of 1:100.

The Single Strategy To Use For Best Broker For Forex Trading

The spread is the void between the proposal and offer (likewise known as 'ask') rates of a currency pair. This suggests that the best rate that you can currently acquire EUR/USD is 1.14133 and the finest rate you can currently offer at is 1.14123.

A pipette is one tenth of a pip, typically in the 5th decimal place. Foreign exchange trading has essential advantages and downsides contrasted with other markets. Recent growths in the equities market, such as the development of fractional share trading and commission-free trading, have worn down several of the advantages of forex.

Report this page